SFTR: The final countdown

UPDATED 18 December with additional links and further details on timelines for trade repository reconciliations for certain fields.

Now that the ITS and RTS have been released, we have greater clarity on the nature of the European Commission standards for SFTR as well as the timelines. Our SFTR specialist Jonathan Lee highlights the key changes and the timeline for implementation.

On Thursday 13 December 2018, the European Commission (EC) adopted Regulatory Technical Standards (RTS) and Implementation Technical Standards (ITS) covering Article 4 ‘Transparency of SFTs’ reporting requirements under Securities Financing Transaction Reporting (SFTR). This critical step puts the wheels in motion for SFTR to become a live reporting obligation and sets an increasingly clear timeframe for the reporting to start from April 2020.

Official links: EC RTS, RTS Annex 1, and EC ITS and ITS Annex 1 and RTS for Trade Repositories (TR), RTS for TR Annexes and RTS for Access to details of SFTs held in TRs.

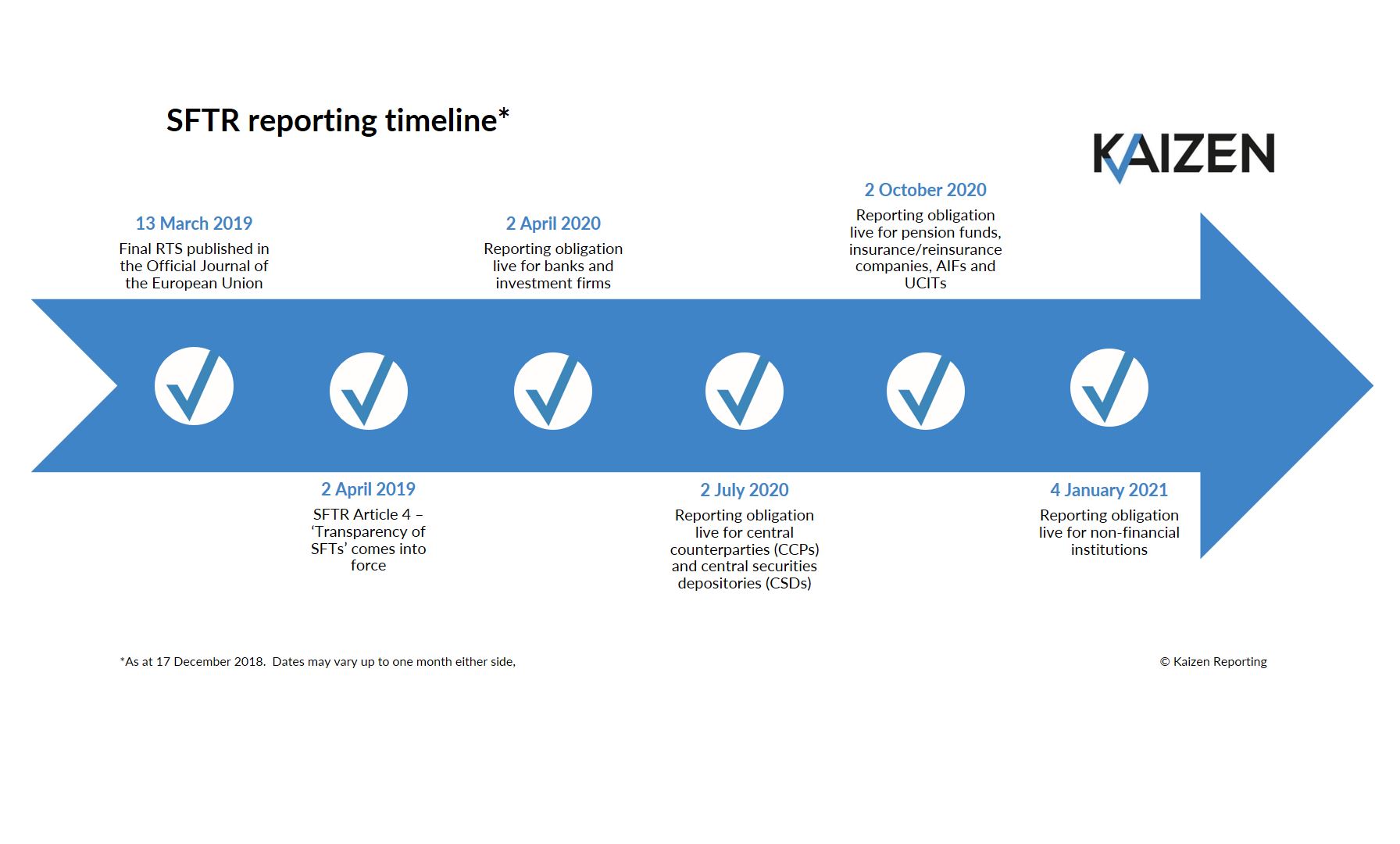

SFTR go-live timeline

The RTS and ITS have been subject to some minor revisions since the ESMA publication, therefore we can confirm that it will be subject to a three month scrutiny period by the European Parliament & Council (not the one- month period for an unchanged RTS, nor the six-month period for an RTS subject to significant, material change). Following this scrutiny, it will be published in the Official Journal of the European Union.

The timeline from here is as follows in the graphic below, although experience tells us to leave approximately one month leeway around these dates:

Changes to the RTS

While this announcement was much more about certainty of timing (after an extended delay), enabling European SFT counterparties to plan and budget for implementation, nonetheless there are some changes of note relative to the 31st March 2017 ESMA text. We can confirm that:

- It will be possible to include agent lenders on repo trades.

- There is a not-applicable option on termination optionality for repo and securities lending trades.

- There is more substantive guidance on the Unique Trade Identifier (UTI) creation waterfall (see Article 3, page 4 of the ITS).

- Timelines for Trade Repository reconciliations for certain fields have changed. The following fields in the Transaction Data table Loan section: Security quality, Maturity of the security, Jurisdiction of the issuer, LEI of the issuer and Security type – have been brought forward to Day 1. They were previously Day 1 +24 months in the 2017 ESMA text. This will present a more pressing data quality challenge. As a small concession in Transaction Data Collateral section: Collateral unit of measure, Price currency, Price per unit and Collateral market value have been pushed back from Day 1 to Day 1 +24 months. This brings the importance of independent reference data testing to the fore.

- Finally and perhaps most significantly, any bad blood between the EC and ESMA over the adoption of UTIs and branch LEIs appears to have ended. The EC has stated that that once standards are finalised and considered suitable for the purposes of reporting SFTs, the regulation will be amended accordingly. In the interim, ISO codes should be used to identify branches and bilaterally agreed UTIs should be used to identify SFTs.

We can help you put the right controls in place

As we look forward to the festive season and find time to step away from all this talk of SFTR, we would encourage you to ensure that projects are now underway. Now is the time to start SFTR budgeting, hiring, planning, building and thinking about testing, controls and governance if your project has not already begun.

Need some help with your SFTR reporting implementation? Contact us for a consultation to find out how you can put the right controls in place to ensure accurate and effective reporting from day one. We are also rolling out an SFTR training course early in 2019 so again, please get in touch to register your interest or find out more.

- Read Jonathan’s statement on 13 December when it was announced the RTS had been adopted.